Finally moving out on your own is an exciting time. You're branching out alone and you'll soon have your very own space. But, you may be at the stage where you're trying to figure out how much rent you can afford each month. It's something that can cause quite a headache, but all it takes is some careful budgeting.

There's a lot to think about when it comes to deciding your rental budget. We're going to help you figure this out by taking you through:

- Budget planning

- Council tax

- Household bills and charges

- Upfront costs

- Average rent by UK region

This may be the first time you'll have to take on the responsibility of bills and taxes. It's not as complicated as it sounds and we'll take you through everything so you feel fully prepared.

By the end of this rental affordability guide, you should know exactly how much rent to budget for. You'll hopefully be able to move into your dream home in no time, stress-free.

Budget Planning

When you first move out on your own, you may have to do a complete budget review. Your disposable income will have to change to accommodate your new bills. You may even have a period of adjustment while you get used to the new expenditure.

As well as your rent, you'll probably have other monthly outgoings that are new to you. Even if you choose to house share, you'll have bills such as internet and TV services to pay for.

Some of the most common monthly expenses to make sure you budget for are:

- Internet

- TV Licence

- Streaming services

- Landline telephone

- Contents insurance

If you've been living at home or in student halls, these may have been taken care of for you. Even if you have a contract with bills included in the rent, these will be added extras you'll have to think about.

Budgeting techniques & tips

If you are budgeting for the first time, you may be wondering how to get started. There are plenty of techniques that you can use to pull together the perfect monthly budget. Which one is right for you will depend on your income and your lifestyle.

Zero-based budget

This is the most basic budgeting technique. With the zero-based budget, you calculate your expenses until you match your income. This is a good way to see where the majority of your outgoings are.

If you want to use this technique to plan your budget including your rent, then start with a general cost. It's advised to start with around £500 PCM and work from there.

For utilities, try the Compare The Market bills calculator. This asks you different questions to determine a general cost for your monthly bills. The perfect tool for getting a better idea of how much your new home will cost you. Don’t forget to include social and leisure costs, from the gym to days out with friends.

Once you've plotted all your expenses out if the cost comes to more than your income you can review it. Start to look for places you can cut back. It may mean cancelling unnecessary direct debits or giving up a luxury that you don't use.

If you find you have more income left over, try increasing your rent budget and see what your expenses look like. Doing this in a spreadsheet allows flexibility, so you can go in time and time again to adjust costs.

Savings & debt priority

This technique makes sure that you're putting money away, as well as settling your debts. Creating priorities while planning a budget is very important. Take care of the essential costs first before spending money on luxuries.

You could combine this technique with the zero technique. Put aside a set amount each month for paying off loans or credit cards and adding to your savings. This can help you create an emergency nest egg should you need it. Plus, it will help you decrease debts and could improve your credit score in the future.

Of course, it's important to make sure you always have enough to pay your bills and rent. If you find you are putting aside too much, you may have to decrease this savings amount.

50/30/20 budget

This technique combines the best of both of the previous techniques. The 50/30/20 budget helps you to split out your outgoings based on priority.

The idea is that 50% of your expenses will be necessary expenses. These include rent, bills and food. A further 30% will be discretionary expenses. These include things like leisure and social activities, TV streaming and more. The final 20% will go towards your savings and debt payments.

These three sections can be adjusted depending on your personal goals and priorities. For example, you may have a big savings goal and want to distribute 30% of your income to savings.

The key to any good budget is knowing what is essential and what is discretionary. The main costs that top the priorities list are:

- Rent

- Council Tax

- Utility bills

- Groceries

- Transport*

*This depends on whether you need transport to get to and from work. It will include car repayments, fuel costs, insurance and tax. Or, public transport costs.

When budgeting for leisure and social activities, remember that these are non-essential. Although it's good to put money aside for these things, be realistic about how much you can afford to spend.

A general rule for putting money aside for leisure is to save around 10-15%. This is the average monthly consumer spend on leisure and social activities, so it's a good place to start.

The best apps for budgeting

Although you can't beat a good spreadsheet, these days there are much easier ways to track your budget. There are lots of apps on the market that are easy to use and help you keep up to date with your monthly expenses.

When choosing the best budgeting app, think about what features you'd like. For example, do you want it to link directly to your bank account? Do you want easy-to-read graphs that show you where you're spending the most money? Would a weekly spending report be helpful?

Below, we've put together 3 of our favourite budgeting apps so that you can get your new budgets sorted.

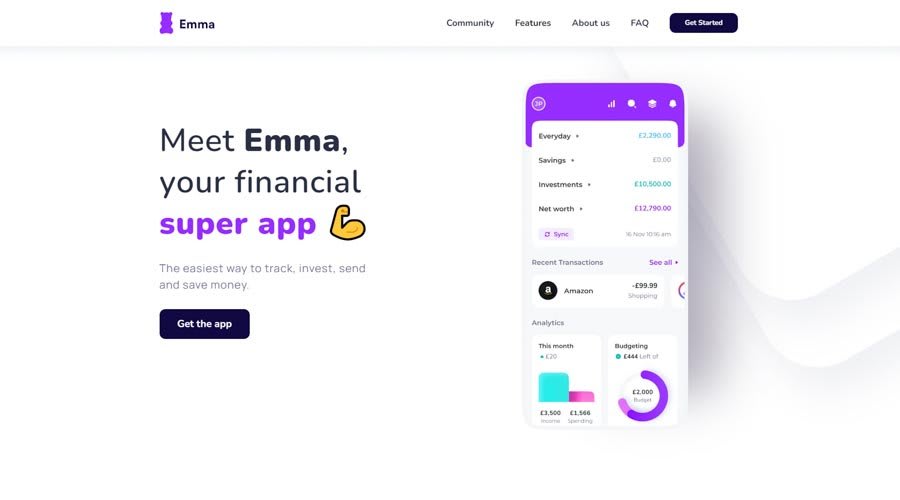

Emma

With 10k ratings averaging 4.7 stars, Emma is a simple budgeting app with all the best features. Emma can show you how much money is in your bank, and your debt and lists all your recent transactions.

Even if you have many bank accounts, you can use Emma to manage all of them at once. Plus, set individual budgets within the app and track all of your spending with handy charts.

The app also pulls together weekly reports to help you identify where you may be spending too much. Perfect for figuring out where to cut back.

Fudget

Fudget has over 1.5k ratings, giving it an average of 4.8 stars. This app is much more stripped back than the Emma app. It allows you to visually see how your expenses put a dent into your income.

This is a good app if you want something to help you plan out monthly budgets. Plus, keep track of how much you have left in the bank or how much disposable income you will have.

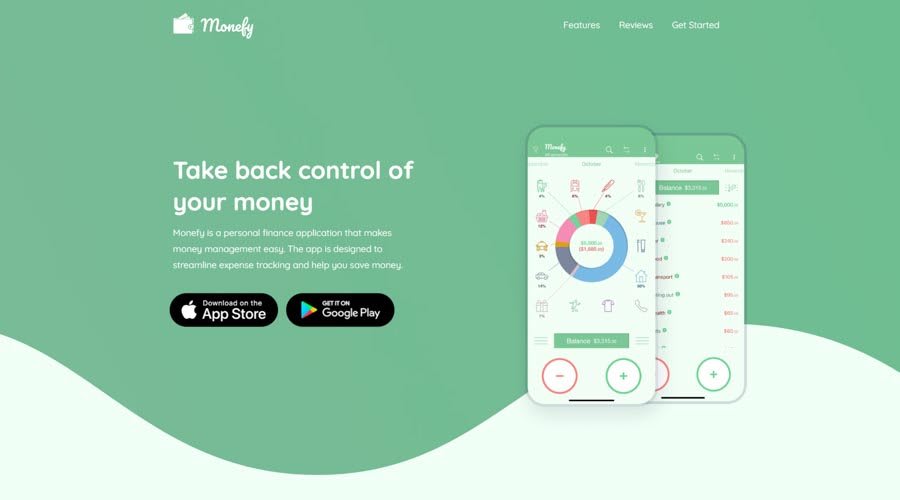

Monefy

With 533 ratings and an average star rating of 4.7, Monefy is a great in-between app. The design is very modern and uses icons and charts to help you better understand your spending. It's the perfect blend between the many features of Emma and the simplicity of Fudget.

Monefy offers detailed overviews of your outgoings, but you have to add them manually. You can create recurring payments, so you don't have to input the same costs month on month.

When it comes to knowing how much rent you'll be able to afford, it's best to start with budgets. Knowing what your income and expenses are will make it very clear how much you can afford to spend on rent.

Council Task & Other Household Charges

When it comes to paying for your own place, there's more to think about than just the rent and utilities. Other household charges will need to be considered when thinking about your rent.

Council Tax

Your council tax will be one of your biggest expenditures after rent, so it's best to plan for it early. This tax goes to your council to cover:

- Local police and fire services

- Recreational areas such as parks and gyms

- Libraries and education

- Waste collection and disposal

- Road maintenance and transport

- Record keeping like marriages, births and deaths

What you'll pay will depend on the council tax band you fall into. This can easily be checked with just a few details on the GOV website.

In England, your council tax band is based on what the value of the property was on April 1st 1991. If one property is in one council tax band, it doesn't mean that another property in the same area will be in the same band.

To give you a quick idea of how council tax bands work, here's a rundown.

| Council Tax Band | Property Value Ranges |

| A | Up to £40,000 |

| B | £40,000 - £52,000 |

| C | £52,000 - £68,000 |

| D | £68,000 - £88,000 |

| E | £88,000 - £120,000 |

| F | £120,000 - £160,000 |

| G | £160,000 - £320,000 |

| H | More than £320,000 |

If you're looking at a new property, then the council tax band will be determined by the following:

- Property size

- Property layout

- Character

- Location

- Change in use (if applicable)

- Value on a certain date

- The Council Tax band of similar properties in the area

If you're renting a property, who is responsible for paying the council tax bill? The tenant or the landlord?

Unless stated in your tenancy agreement, you will be required to pay your council tax. There are some rental properties that will include council tax in their monthly rent. However, this isn't a standard and it should be confirmed before signing.

Furnishings

When choosing to rent there will be three types of rental you can opt for. A furnished apartment, unfurnished and part-furnished.

- Furnished - Furniture comes with the property, including sofas, white goods, beds etc.

- Unfurnished - The property will be empty when you move in. This means you'll have to buy your own furniture and white goods.

- Part-Furnished - Comes with some basic pieces of furniture. You'll usually find this applies to white goods. It can also apply to beds and sofas.

Which rental you choose will depend on whether you want your own furniture. Some people prefer unfurnished because they can create their decor from scratch. If you're on a budget, furnished is a great option because you save money on furnishings.

In furnished properties, you'll be able to tick the most expensive pieces off your list. You may need to buy smaller items like cutlery but the essentials will be included.

For those that want the best of both worlds, part-furnished is ideal. This option can help lighten the cost of the bigger items like fridges and washing machines. It gives you the flexibility to buy furniture that matches your style and comfort level.

A hidden cost you may want to consider is that of a removal van. If you're moving out and want to bring furniture with you, you'll need to rent a van to help you. This can be an added cost to the moving day that can catch you off guard.

Content Insurance

This leads us nicely to our next point, content insurance. If you have chosen a furnished rental, then your landlord will have content insurance. This is to protect the items included in your rental. It's advised that you also get content insurance, for your personal items. This can help protect against damage or theft of items like laptops, TVs and other valuables.

The same applies to part-furnished properties. Again, your landlord may have cover for the items that belong to the rental, but you'll want your own cover. This becomes even more important when you have an unfurnished property. Protect your belongings in unforeseen circumstances like fire, theft or damage with insurance.

Although content insurance may seem like an un-essential cost, it's better to have it than not. Should something happen to your items in the rental property, you'll want to replace them. Content insurance can offer this extra level of protection to put your mind at ease.

Finding the best content insurance

To find the best deal on your content insurance, use a comparison site. There are plenty of sites that search the internet for the best deals based on your information. Some of the most popular are:

All of these sites will offer you content insurance quotes from different providers. You can then choose the best insurance that fits your budget.

Some things to look for in a good content insurance policy are:

- Loss and damage cover for items of £12,000 or more

- Money in the home of a value of £500 or more

- Freezer cover of £300 or more - if your freezer breaks down and you need to replace the contents

- Items left outside within the property's boundaries - this may not apply to apartments

- Theft from outbuildings for £2,000 or more

- Personal liability for up to £2 million

- Tenants' liability for £10,000 or more - this one is important for renters. It protects you from legal responsibility for the landlord's fixtures and fittings.

It's also a good idea to find a policy that covers you for

- Accidental damage

- Water loss

- Repairs

- Emergency repairs

- Legal expenses

Good content insurance can give you peace of mind when renting. Although it's an extra expense to consider, should something happen it will cost you a lot more.

Utilities

Your utilities are the basics you need to keep your home up and running. These include

- Water

- Electric

- Gas

You'll often hear of these referred to under the umbrella term 'energy supplier'. When renting your landlord will already have your utilities set up. It will be your job to choose an affordable energy supplier.

Much like your content insurance, you can use comparison sites to find the best deals. The best website to use for this is Uswitch, as it can help you see what supplier is being used and cheaper offers. Simply put in the rental property postcode to start budgeting for your energy bills.

Other than price, good customer service is essential for the best utility deals. Being able to easily get through to your provider will make all the difference. This could help to relieve stress in the future and help you sort out emergencies quicker.

Keep in mind that we're currently in an energy crisis which is making utility bills expensive. If you're looking to rent, this will have to be placed on the top of your budget plan. Remember, your utility bill payments count towards your credit score. In order to keep a good credit score, you need to make sure you can afford these monthly bills.

Money Saving Expert recently created a fantastic tool for choosing the best energy supplier. This tool helps you to pick the right tariff, comparing the energy market and showing you the best ones for you.

How to pay for your utility bills

If you live in one of our Essential Living apartments then we negotiate a package for you. You then pay a simple monthly fee alongside your rent.

Many energy suppliers will allow you to create an online account so you can pay online. Like any other bill, you can also set up an easy direct debit. This method means you don't have to worry about manually paying each month.

If you find you need to pay with cash, then you can head to your local Post Office. The Post Office will often allow payments from the majority of energy suppliers. Keep in mind though, that there may be a counter charge for cash payments.

Upfront Costs

Before you move into your new rental there will be some costs to keep on top of. Often, it's the moving and admin process that is the most costly part of renting.

Deposit

When you find the property you'd like to rent, you are required to pay a deposit in order to secure it. Your landlord will put your deposit in a Tenancy Deposit Scheme. These schemes or (TDPs) are government approved to ensure you have full protection.

Your deposit is returned to you once you've vacated your rental property. This is unless there are any damages that need to be paid for. Any cost to repair or replace anything in your rental property when you leave will be taken out of your deposit.

The tenancy deposit can be a costly one, so you may need to save before you seal the deal. A deposit is around 4-5 weeks' rent. It is illegal for a landlord to ask for more than 6-weeks rent as a deposit. Usually, the landlord will ask for this amount to cover your first month in your new home.

Holding deposits

Holding deposits are not the same as a deposit. Holding deposits keep the property off the table for other renters for a period of time. This fee may not be refunded so it's essential that if you pay a holding deposit you are 100% sure you want the property.

If you do pay a holding deposit then you will have 15 days to sign a tenancy agreement. After that time the landlord can offer the property to other potential tenants. Meaning you're unlikely to get your holding deposit back. This deposit is usually around 1-weeks rent. You may also be asked to pay a full deposit once you've signed the agreement, so keep that extra cost in mind.

The landlord may decide to change their mind within that 15-day window. If that's the case, your holding deposit will be returned to you.

Agency Fees

If you are renting in the private sector then you may be worried about agency fees. These agency fees cover the cost of

- Collecting references

- Admin

- Credit and immigration checks

- Renewing your tenancy after your fixed-term contract ends

However, there is good news. As of 2019, the Tenant Fees Act has banned most letting fees. This act also capped deposits for homes with an annual rent of over £50,000. This means that if you do rent a property with an annual rent of £50K or above, you won't pay more than 6 weeks' rent as a deposit.

If a letting agent does attempt to charge you for agency fees, then you can report it to Trading Standards.

Moving Day

Something else you may want to consider is the cost of moving day. Moving day is exciting but it can be costly if you're not prepared.

Factor in the cost of hiring a removal van or removal services. It's also advised to book in advance so you can get the cheapest deal. Leaving things to the last minute could end up costing you a lot more.

Make sure when you hire a van, you give yourself plenty of time to pack up and unload. There may be unforeseen obstacles that pop up, so give yourself more time than you need. Doing this will help you avoid any late return fees on your moving van.

Think about the petrol you'll need, food and overnight accommodation if you need it. It can help to visualise the day as a whole to spot any hidden costs that might come up.

Calculating Rental Affordability

Your annual income will make a big difference to what you can afford to rent. Not only to cover costs, but landlords may need a min income to rent certain properties. This helps them to choose tenants that are most likely to pay on time. If you don't meet the minimum income, then a guarantor may be needed. A guarantor is a family member or friend that offers to pay any outstanding payments if you cannot.

When it comes to getting an idea of how much rent you can afford, there's a formula you can use. Currently, the household income should be roughly 30x the monthly rent. Below, we've created a table so you can easily find how much rent you could afford each month.

| Monthly Rent | Household Income |

| £800 | £24,000 |

| £1,000 | £30,000 |

| £1,200 | £36,000 |

| £1,400 | £42,000 |

| £1,600 | £48,000 |

| £1,800 | £54,000 |

| £2,000 | £60,000 |

| £2,200 | £66,000 |

| £2,400 | £72,000 |

| £2,600 | £78,000 |

| £2,800 | £84,000 |

| £3,000 | £90,000 |

| £3,200 | £96,000 |

| £3,400 | £102,000 |

| £3,600 | £108,000 |

| £3,800 | £114,000 |

| £4,000 | £120,000 |

It's recommended that you create a monthly budget using all the tips we've suggested. Once you have your personal budget, you can compare it with the table. Everyone's circumstances are different. So although these averages are handy, they should be taken with a pinch of salt.

Average Rent by UK Region

Finally, let's take a look at the average rent around the UK. This can help you get a better idea of the price range you may be looking at. Again, these are averages so you may find somewhere cheaper or more expensive.

| Region | Average Rent (as of Jun 2022) |

| Greater London | £1,846 |

| South East | £1,190 |

| South West | £1,053 |

| East England | £1,071 |

| West Midlands | £826 |

| East Midlands | £770 |

| North West | £883 |

| North East | £588 |

| Yorkshire & Humberside | £761 |

| Northern Ireland | £754 |

| Wales | £752 |

| Scotland | £812 |

*Statistics sourced from Statista

Although these are the averages for each UK region, there may be fluctuations in areas. If you live in a big city, rent will be higher than property in suburban areas. For example, a one-bedroom flat in Manchester city centre is on average £758.60 PCM. Yet, outside the city centre, a one-bedroom flat is on average around £541.04 PCM.

As a whole, the average rent for the UK as of June 2022 is £1,113 PCM. As you can see, your location will have a huge impact on your rental prices.

The size of the property you're looking to rent will also have a big impact on the monthly cost. Not just in rent but also in utilities and council tax. You may look to share a larger property with others to split the cost of the bills. In the more expensive areas such as cities, many people will share with roommates to split costs. This can sometimes work out cheaper than renting a property on your own.

As you can see there are lots of factors to take into consideration when determining what you can afford. It's best to start by reviewing your current expenses and income to see how much you can afford. From there you can cut back on spending that is not essential and start budgeting for your new home.

If this is your first time renting then we have many resources that can help you with the transition. If you'd like a list of everything you need to sort out, then take a look at our Checklist for First-Time Renters.

Don't forget to take a look at our very own Essential Living locations if you're looking to move to London. We have a number of properties that make renting easy and fun.