London remains one of the most exciting cities in the world, attracting thousands of international movers each year. With its diverse culture, professional opportunities, and rich history, the city continues to be a top destination for expatriates and new residents. As of mid-2024, London’s population was estimated at approximately 9.061 million, reflecting a yearly increase of around 111,000, primarily driven by international migration.Apps.london.gov.uk. Office for National Statistics

If you're considering moving here, this guide will address common concerns and essential planning tips to make your transition as smooth as possible.ed to the UK last year, with London as the prime destination for many.

Relocating to a big city can feel overwhelming, but with the right guidance, you can avoid common pitfalls and feel confident about your move. This guide provides crucial insights into settling in the city, covering everything from transportation and housing to budgeting and neighbourhood selection.

Should I move to London?

Uprooting your life is always going to be a hard decision to make. You may even be questioning whether London really is the right place to settle down.

London is one of the most populated cities in the UK, being England’s capital and hub of British culture and tourism. Deciding to relocate, especially to a bustling city like London, is never easy. London, one of the world's most diverse cities, boasts over 9 million residents. Around 37% of the population born outside the UK.

London’s 607 square miles are split into 32 boroughs, each with a distinctive vibe. Whether you prefer Camden’s indie culture, Soho’s artsy scene, or the financial hubs of Canary Wharf, identifying the right neighbourhood is key to settling comfortably in London.

When choosing a place to live, consider:

- The kind of people and lifestyle you want to surround yourself with.

- Proximity to work, schools, and social amenities.

- Your budget and the cost of living in different boroughs.

Getting around London

Each area of London is easily accessible through the city’s reliable public transport network. This includes regular tube services, buses, overground railways and plenty of taxi options.

London boasts an efficient public transport system, making it easy to navigate the city. Transport for London (TfL) operates the following services:

- London Underground (Tube)

- Buses

- Overground trains

- Trams

- Docklands Light Railway (DLR)

- Emirates Air Line cable car

- Thames Clippers River Bus

Understanding London's Transport Zones

The city is divided into six transport zones:

- Zone 1 (Central London): Includes major tourist attractions and shopping districts.

- Zone 6 (Outer London): Includes Heathrow Airport, Romford, and Uxbridge.

These zones make it much easier to understand transport charges and ticketing. For visitors, a Zone 1 ticket can be great for visiting tourist attractions in central London. If you're planning to commute, you'll likely need a ticket that includes multiple zones.

Transport Costs & Payment Methods

- Oyster Card: A prepaid travel card offering discounted fares.

- Contactless Payment: Debit/credit cards with contactless functionality can be used on all TfL services.

- Travel Passes: Save money with weekly, monthly, or annual passes if you’re commuting regularly.

- Fare Cap: Limits daily and weekly travel expenses to a set maximum, helping commuters save money.

Black cabs and ride-hailing apps like Uber and Bolt are available, but they tend to be more expensive than public transport. The minimum fare for a black cab is £3.80.

Cost of Living in London

In 2025, there’s no denying that London, like most capital cities, can be an expensive place to live. However, there are still many ways to manage costs and make city life more affordable.

Living Costs in London

London is one of the most expensive cities in the world, but proper budgeting can make life more affordable.

Monthly Living Costs

- Single person: Approx. £1,045 (excluding rent)

numbeo.com - Family of four: Approx. £3,690 (excluding rent)

numbeo.com

Housing Costs

- One-bedroom apartment in city center: £1,750–£3,000/month

expatica.com - Three-bedroom apartment in city center: £3,500–£6,500/month

expatica.com

Additional Expenses

- Utilities (Gas, Electricity, Water): Approx. £140/month

- Internet, Mobile & Streaming: £50–£100/month

- Groceries & Dining: £250–£500/month

- Socializing: Pint of beer £5, cocktail £10

Location and Cost Impact

Where you choose to live in London greatly affects your cost of living. Properties in Zone 1 tend to have much higher rents and expenses compared to the outer zones like Zones 5 and 6. While opting for an outer zone can save on rent or mortgage costs, consider potential increases in transport expenses, particularly if you commute to central London. Balancing these factors is essential when budgeting for life in the city (Source: TfL).

Comparison to Other Major Cities

Compared to cities like New York, Milan, Sydney, and Tokyo, London’s overall cost of living remains moderate, though housing can be notably high. Rental prices vary widely depending on location and property size. As of 2024, the average rent in London is around £2,500 per month. For families needing more space, expect higher costs, especially in sought-after neighbourhoods (Source: Zoopla UK Rental Market Report 2024).

Council Tax in 2025

In addition to rent, council tax is a significant factor in London’s living costs. Council tax rates differ by borough and are divided into eight bands, A through H, based on the property’s capital value. Band A properties have the lowest rates, while Band H properties are the highest. Once you’ve selected a neighbourhood, you can use the government’s online calculator to determine the exact council tax rate based on your postcode (Source: Gov.uk Council Tax Rates).

Living in London in 2024 requires careful budgeting, but understanding the impact of location, council tax, and family size can help make it more manageable. Whether you’re seeking to live centrally or in the outer boroughs, considering these factors will allow you to make informed decisions and find the best balance for your lifestyle.

The Cost of Socialising

One of the complaints you’ll hear most often from people visiting or socialising in London is the cost of a night out in London. Although it can vary from place to place, an average pint of beer will cost £5.00 according to money.co.uk’s Global Beer Lover’s City Index. If you prefer spirits, be prepared to pay up to £10 a drink.

Again, the location will play a big part in the cost of socialising. If you choose to head out within the City of London you’ll find prices much higher than that further afield. Areas within Zone 1 tend to be catered toward heavy tourism traffic and you’ll find the prices in bars, restaurants and clubs reflect this.

To beat the tourist traps you can find plenty of cool bars and clubs in Zone 2 areas such as Camden, Brixton and Dalston.

Opting for smaller independent restaurants, bars, cafes and even shops can help you spend a little less than you would in the larger chains. Keep an eye out for events or special offers which can help keep costs down even further when heading out to socialise with friends.

The Cost of Utilities

The monthly utilities are another vital factor to consider when moving to London. Here, electricity, heating, water, and waste disposal may be determined based on the size of the apartment and location.

In 2025, the average monthly utility costs for a typical household in the UK are approximately £175, encompassing both gas and electricity.

Switcheroo

This estimate is based on a medium-sized household with average energy consumption. It's important to note that actual expenses can vary significantly depending on factors such as the size of your home, the number of occupants, and individual usage patterns. For instance, larger homes or those with higher energy consumption may experience increased utility bills. Additionally, regional variations and the specific energy tariffs you choose can also influence your monthly costs.

A great option is to choose a build-to-rent landlord such as Essential Living. Our studio and 1-3 bed apartments come with free WiFi. This can help ease the stress of having to budget separately for utilities because everything is included in a set monthly price. Access to fantastic communal amenities such as a roof terrace, games room, gym and BBQ help keep social costs low.

Other utilities to consider and include in your monthly budget are:

- Mobile phone

- WiFi

- Cable/Satellite TV

- Streaming Subscriptions

All these expenses make up the real cost of living in London. It's important to consider how these costs will likely affect you before making the ultimate decision to move.

The Best Places to Live in London

When preparing for your move you’ll want to choose a location that has everything you want, both for work and life. As previously stated, each borough of London has something different to offer.

The boroughs within London fall into five primary regions, which are:

Within these regions are various boroughs and neighbourhoods to choose from. Some will be ideal for the young professional looking for a vibrant social life close to work. Others will appeal more to families who want a home close to good schools and green open spaces.

Below is a summary of our favourite places to live in London, but be sure to check out our comprehensive guide.

Best for Families - Greenwich

A great place to live for families, Greenwich has everything you could need for the perfect family life. With the large Greenwich Park in the heart of this neighbourhood, there is plenty to keep kids and adults of all ages entertained.

This area of London is best known for its maritime history and is adorned with plenty of museums, monuments and galleries to explore. Situated in southeast London, Greenwich is right next to the river Thames and the O2 arena. There’s plenty of public transport getting you in, out and around London. Plus, this is one of the best areas in London for commuting to Canary Wharf. For those working or looking to work in the financial services district, this is the ideal neighbourhood for you.

As of December 2024, the average monthly rent for a two-bedroom property in Greenwich is approximately £1,856, reflecting a 7.7% increase from the previous year. ons.gov.uk For those considering purchasing, the average price for a two-bedroom home in the area is around £700,000. rightmove.co.uk

If you’re interested in moving to the Greenwich area, our Union Wharf building is ideal for families looking for a slice of London life. Union Wharf also has an on-site nursery and green areas to keep kids and parents happy and taken care of.

Best for Young Professionals - Bethnal Green

If you’re a young professional looking for an area that’s well connected and has a lot to offer socially, then Bethnal Green is a great place to settle.

Here you're situated right next door to the stunning Victoria Park as well as Bethnal Green Gardens and Mile End Park. There are plenty of nearby green spaces to relax and switch off. This part of the city also has great transport links. Bethnal Green tube station is on your doorstep and Whitechapel and Cambridge Heath walking distance away.

This neighbourhood is very popular with young professionals. It's a great community to be part of if you’re looking for like-minded people. With lots of cafes and bars, you’ll always have somewhere to meet friends old and new.

As of January 2025, the average monthly rent for a one-bedroom apartment in Bethnal Green is approximately £1,995. rentberry.com For those considering purchasing, one-bedroom properties in Bethnal Green have an average price of £475,807.getagent.co.uk

You can also take a look at our very own Bethnal Green apartments at Dressage Court. Our apartments offer great social spaces including a roof terrace, work from home space and a games room to enjoy with your neighbours.

Best for Students - Brixton

Brixton is a great place for those looking to study and work in London. It's filled with the vibrant nightlife and sociable atmosphere that all students crave. Ideal for music lovers and those in search of the sights, sounds and smells of Caribbean culture, Brixton has proven popular with young people over the years.

Brixton tube station has great links to central London. You can choose from the Victoria tube line or Souteastern rail services from Brixton Station. There are also plenty of bus routes to get you to around south London.

There are plenty of green spaces to enjoy when you’re not studying, including Ruskin Park and Brockwell Park. Perfect for taking a break from being in lectures or in classrooms. With everything from delicious artisan coffee shops to traditional Caribbean eateries, It’s both a great place to live and study.

As of December 2024, the average monthly rent for a one-bedroom apartment in Brixton is approximately £2,141.rentberry.com For those considering purchasing, the average sold price for properties in Brixton over the last 12 months is £580,041.kfh.co.uk

Commuting into London

If you’re going to be working in London but want to be able to escape the city after work and on weekends, then you may be looking for the perfect commuting towns instead of a place within Greater London.

There are some very popular towns that offer great transport links to and from London. Maidenhead is where you'll find out Berkshire House development, and it's just 40 minutes from central London. Other areas to consider for commuting are:

- Luton in Bedfordshire

- Three Bridges in West Sussex

- Epping in Essex

- Amersham in Buckinghamshire

Some things to keep in mind when looking for the best towns for commuting to London are the cost of travel and the time it takes to get in and out of the city.

If you're looking for more great places to live near London, we've got you covered.

Why Renting is the Best Option in London

When first moving to London, it’s best to start by renting a property rather than buying one. With every area of London so different, renting offers you the chance to explore different parts of the city.

Buying a home is said to be as one of the most stressful activities we go through in life. You'll want to be 100% certain that you’ve chosen the perfect location before putting a deposit down. Renting allows you to explore all your options and enjoy freedom with shorter commitment times than getting a mortgage.

The Cost of Renting vs. Buying

Renting in London offers significant advantages, particularly for those who want flexibility and lower upfront costs. Compared to buying, renting allows for shorter commitments, with tenancy agreements that can range from rolling monthly contracts to fixed 12-month terms. This is beneficial for individuals who may be unsure about where they want to settle in the long term.

Financially, renting requires a much lower upfront cost compared to purchasing a home. Mortgage deposits in London typically range from 5% to 10% of the property price, whereas rental deposits are usually capped at five weeks’ rent. Renting also requires a much lower upfront cost, so you can move around much more quickly without having to save up a huge amount for a deposit. When buying, you can expect to have to pay from 5% to 10% upfront as a deposit. Compared to rental properties where you only have to pay a maximum of 5 weeks as a deposit on properties where the rent is under £50,000 per annum or 6 weeks where the rent is over £50,000. Additionally, renting eliminates the responsibility of home maintenance, as landlords are typically responsible for repairs and property upkeep.

For those looking to buy, homeownership does come with additional costs such as stamp duty, mortgage repayments, and property maintenance. However, purchasing a home can be a great long-term investment, particularly in high-demand areas.

Ultimately, whether renting or buying is the best choice depends on individual circumstances, financial stability, and long-term goals.

The Cost of Maintenance

On top of large mortgage deposits, you’ll also have to consider the maintenance of your new home. When you buy a property you are solely responsible for its upkeep. This means if anything goes wrong such as a plumbing or electrical emergency, you are responsible for rectifying it.

With rental properties, it will usually be up to your landlord to fix any issues or at least support you to get the problems fixed. Any costs that add up for the maintenance of the property will usually be covered by your landlord so it becomes one less thing to worry about.

In a build-to-rent development like our properties, the 24hr on-site residents’ team are always on hand to help you with any emergency or maintenance issue you have. With all utilities included in the price of the rent, all you have to worry about is paying your set monthly rent each month.

Flexibility

Buying a home is not only a big financial commitment, it’s also a big lifestyle commitment. Renting a property can give you more flexibility. Whether it’s upgrading your property for something more luxurious when that big pay rise comes in or downgrading to a smaller place when current rental prices get too much. You’ll have much more financial freedom with renting if you are currently moving through jobs, trying out a location or just trying to figure things out.

Tenancy agreements can range from rolling monthly contracts to more secure 12-month contracts, so you can commit to as much time as you like. The average tenancy agreement is around 12-months however you can also get 6-week agreements if you want more freedom or if you know you may need to move at short notice.

Moving to London Alone

If you’re looking to move to London alone and are worried about going solo then renting will be a fantastic option for you. If you want to have your own space you can look at renting a 1-bed or if you’d like to make some new friends and have a little more company at home. You can then also look for housemates to share the costs of things like rent and utilities.

Essential Living’s studio and 1-bed apartments are perfect for solo Londoners, with plenty of communal spaces and events to allow you to meet other residents. Not only are our locations secure but they can also offer opportunities to meet new people, something that is often tricky to do in a very big city.

How to Choose a Reliable Estate Agent in London

When moving to a new neighbourhood, the fear of dealing with unscrupulous estate agents and property developers is real. However, there are ways you can make sure to find the best estate agents for you and your needs.

Always Insist on Seeing the Property First

If you can, always insist on seeing a property before you make a financial commitment. This is especially true for rental properties. If this isn’t available – which often is the case in such a fast-paced property market like London – then ask if they have virtual viewing available.

Often people will rush into putting a deposit down on a property in order to secure somewhere. Some people even do this without viewing the property first! Although this can be a good way of finding somewhere to live at short notice, it also runs the risk of you tying yourself with poor quality landlords or uncomfortable living environments. Try and check a property out first so you can assess the neighbourhood and neighbours and get a feel of what it would be like to live there.

Consider Fees

You may be preoccupied with deposits and monthly payments and forget that estate agent fees also need to be considered. Many people are caught out by hefty fees when they finally get the bill from their agent. To avoid that, make sure you’re fully aware of their fees and how/when they’ll be charged.

Due to the Tenant Fees Act of 2019, letting agencies are not allowed to charge for a lot of the previously hidden fees, particularly for things like administration or references. However, your letting agent may charge you fees associated with the following:

- Early termination of tenancy

- Utilities

- Communication services

- Council tax

- Late rent payment charges

- Replacement keys or security features

If you’re buying a property in London then you may be subject to costs from estate agents, brokers or mortgage providers which include but are not limited to:

- Valuation fee

- Surveyors fee

- Legal fees

- Transfer fees for electrics etc.

- Removal costs

Pay Attention to Reviews and Referrals

It can be tricky to choose the best estate or letting agent based on face value. Looking at their website or social media will only show you what they want you to see and not the reality of their service.

When you find an agency you like the look of, it’s best to do a few quick Google searches to see if there are any reviews. You may find comments from previous clients or regulatory boards that provide a more authentic picture of what the agency is really like to work with.

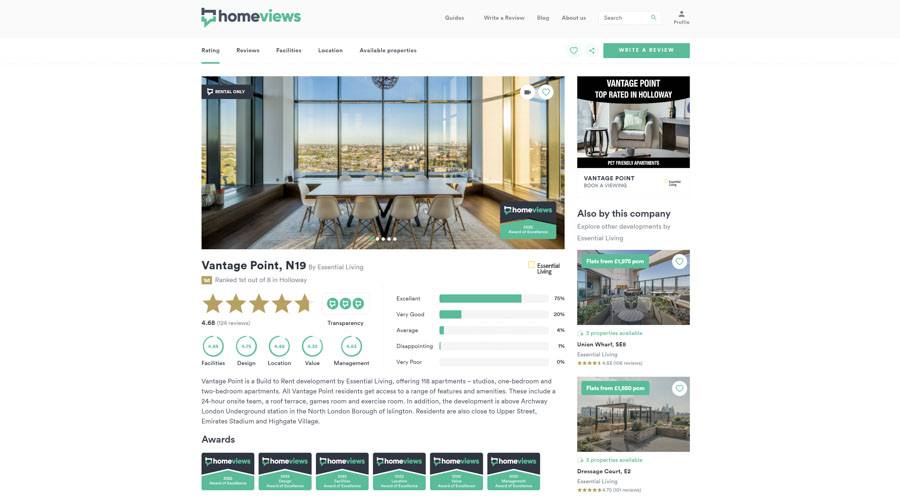

If you’re looking for a reputable landlord, HomeViews offers insight into how residents rate various developments across the capital.

Word of mouth referral is always best because you’re getting a positive review straight from the source. Ask around any of your family or friends to see if they have any recommendations or know someone that can point you in the right direction.

Moving to London Doesn't Have to be a Daunting Task

Moving to London should be an exciting and enjoyable experience but when you start thinking about all the finer details things can start to become overwhelming quickly.

Remember to give yourself as much time to plan as possible and don’t feel rushed into making a decision. Make a list of all the things that are a top priority and also things that you’re not overly concerned about. This can help you narrow down which locations to add to your list and which ones to rule out. Your budget will also be a big factor in your decision-making process, so make sure you’re clear on how much you’re willing to spend to make the move.

If you’re looking to make moving as stress-free as possible, take a look at our four properties across London and we can help you create a lifestyle you love in the city.

Frequently asked questions

1. Is it expensive to live in London?

- London can be costly, especially in central areas. The average monthly cost for a single person is around £2,500, though this varies based on lifestyle and location.

2. What are the best areas to live in London?

-

Depends on your lifestyle:

-

Camden: Arts & music

-

Shoreditch: Creatives & entrepreneurs

-

Richmond: Family-friendly & green spaces

3. How does public transportation work in London?

- London has a comprehensive transport network, including the Tube, buses, and trains. Zones determine fare costs, with Zone 1 being central. An Oyster card or contactless payment is recommended for convenience.

4. Is an Oyster Card necessary?

- An Oyster Card is convenient but not essential, as contactless debit/credit cards are also accepted on all public transport. Discounted faresare also on offer with the Oyster card.

5. How can I find affordable housing in London?

- Consider outer boroughs (Zones 4-6) or shared housing. Websites like Rightmove and Zoopla list rentals.

6. Is London safe to live in?

- Yes, London is generally safe with low crime rates in many neighborhoods. However, as with any city, some areas may be safer than others. Research specific boroughs for crime statistics and safety reviews.

7. What’s the best way to save money in London?

- Get an Oyster card for cheaper transport

- Live in Zones 4-6 for lower rent

- Use supermarket loyalty programs

- Take advantage of free museums and parks

8. Can I live in London on a budget?

Yes, by sharing accommodation, using public transport, and dining in affordable areas like Brixton or Hackney.